7th Union Budget 2024; A Brief Summary!

Finally, the 7th Union Budget 2024 was released on 23 July by FM Nirmala Sitharaman in the parliament. The budget brings surprising expectations and also brings negative expectations. For instance, the government increased the tax rate of STT & Capital Gain Tax.

However, the central government focuses on more farmers, employment (internship), housing, middle class, and MSMEs. Various financial experts reviewed the overall “7th union budget 2024” and gave a rate between 7-7.5 out of 10. The experts claim that the “budget 2024” is good for long-term gain (overall). According to various institutions, the best relief by the government was abolishing the Angel Tax.

1. The Key Announcements By FM Nirmala Sitharaman in 7th Union Budget 2024

FM Nirmala Sitharaman announced some key factors that will be the key focus area in the upcoming 5 years. In her speech; reduction in customs duty rates on cancer medicine, precious metals (gold and silver), mobile phones, etc to lower and control the prices of luxury and medicinal products.

1.1. Let discuss the points those are as follows;

- 15% reduction of customs duty and sub-charges on mobile phones.

- Focuses on empowering four specific castes (labor-intensive empowerment)

- 6% reduction of customs duty on precious metals to reduce the retail price.

- A higher minimum support price was announced for farmers on all major crops. (promise on at least 50% MoC)

- PMGKYA extended an additional 5 years (benefiting more than 80 cr. people).

- The ministry enforces 5 schemes and initiates to encourage employment. (benefit 4.1 cr youth with a central investment of Rs. 2 lakh cr.)

- 1.48 Lakh cr. of provision allocated for energizing employment, skilling, and education.

- Under the new tax regime, an employee can save up to ₹17500 in income tax.

- Abolish Angel Tax under the category of all investors.

- Announcement of comprehensive reforms in the “old tax regime” of Income Tax Act 1961. (under 6 months)

- TDS reduced from 1% to 0.1% on e-commerce operations.

- Corporate tax reduced from 40% to 35% for foreign countries.

- The government proposed to increase tax deduction on the “family pension” from ₹15000 to ₹25000.

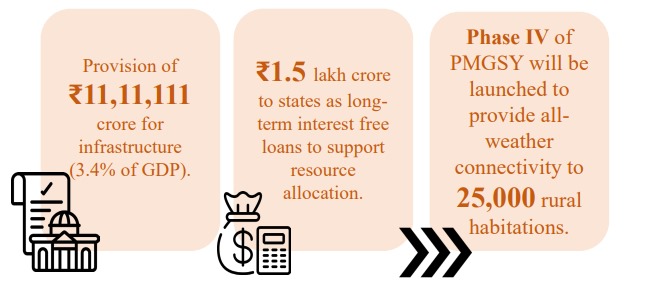

- More than ₹11.5 lakh cr., allocated in the CAPEX market to boost the expenditure and consisting of 3.4% of the GDP.

- The fiscal deficit is est. at 4.9% in 2024-2025 (aim to reduce 0.4%). Thus, a “venture capital fund of ₹1000 cr.” for the space economy. (also reduce BCD and PCBS by 15% on mobile)

- The government introduced the “Anusandhan National Research Fund” to boost and support R&D corporates and created a ₹1 lakh cr. financial pool for private research inductive sectors.

- Allocation of ₹1.52 lakh cr. to empower the Agro-allied sectors from the 7th union budget 2024.

- A major boost to the employment sector where the government announced;

- one month’s wages to all formal sectors

- DBT of 1 month’s wages in 3 installments (only first-time employees)

- Up to ₹15000 for registered in EPFO

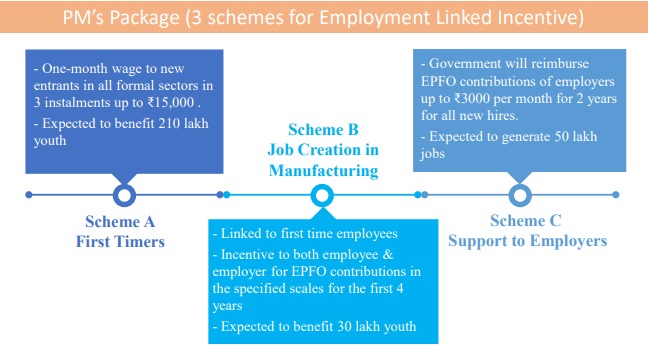

- The government introduced three new schemes and an innovative approach to boost employment and skill with a package “Employment-Linked-Intensive”.

- Scheme; for the first-time employee one month of wage + provide an incentive of ₹30 lakh for 1 month PF contribution + up to ₹10 lakh loan for higher studies in domestic institutions.

- Power project development in Bihar at Pripanti. (2400 MW power plant will be set up and multilateral development for external assistance)

- Announcement of mega social, infra, and power sector boost in Bihar and Andra Pradesh.

- Setting up the development of an industrial corridor at Gaya in Bihar.

- A ₹26K Cr. investment to boost the connective of Buxar-Patna-Bodhgaya-Rajgri-Vaishali-Darbhanga.

- ₹21400 cr. of investment in service infrastructure development in Bihar.

- Whereas, the central government acknowledged the “Andra Pradesh Reorganization Act”.

- However, an investment of ₹15000 cr. will be allocated for major futuristic projects in Andra Pradesh.

- A comprehensive plan to boost internship opportunities in 500 companies to 1 cr. youth in 5 years.

- PM SGMY launched with a promise to install rooftop solar power panels to 1 cr. households. (300 units every month)

- Investment in the tourism sector to boost employment. To make India a Global Tourist Destination.

2. The Structure of the 7th Union Budget 2024

The “budget 2024 theme” is based on its predecessors 2022 and 2023. The central government is following the roadmap of “Vikshit Bharat”. Thus, under the modal of “Vikisht Bharat” the GoI (Government of India) has fixated a goal of developing India while focusing on 4 major castes; “Annadata” (Farmers), “Yuva” (Youth), “Garib” (Poor), & “Mahilayen” (Women).

The “7th Union Budget 2024” theme is based on 4 significant factors; Employment, Skilling, MSMEs, and Middle class. Thus, this time the government solely focuses on labor-intensive methods to improve and channel the youth sector into the mainstream corporate market through internships.

We will discuss the factors in this article and how this 7th budget 2024 will impact the labor market, capital market, infrastructure (economic, urban, and rural), and middle sectors. The major priorities of this 7th Union Budget 2024 were to improve the core sectors while empowering the Neo-middle, middle, youth, women, and poor class.

2.1. Priorities in Agricultural Sectors in 7th Union Budget 2024

The main goal of the ‘Vikish Bharat” is to increase productivity and create a resilient ecosystem for agricultural sectors. To transform the research and development of the agro-sector to boost and develop resilient varieties of seeds under “transforming agricultural research”.

The government also focuses on the national cooperation policy to integrate the corporate level with farmers to directly benefit them. Vegetable production and supply chain, Release of new varieties of 109 new high-yielding and climatic varieties of 32 field and horticulture crops.

2.2. Priorities in Employment and Skill

This budget for 2024 focuses on developing the key areas to encourage youth employment and skills. However, introducing of 3 schemes. Under these schemes, the first-timer, manufacturer, and employee will benefit from the government based on different terms.

2.3. Priorities in Infrastructure

Various incentives and investments were introduced in the housing market, PMGSY under phase 4, and interesting initiatives have been taken to boost all-weather connectivity to the rural sector.

3. Conclusion

In the “7th Union Budget 2024” experts and the middle class expect after hearing the EBS report to introduce more reforms on CGT, STT, and inflation on basic items and goods. However, the government does implement some reforms in the tax regime (both old and new) an increase in tax deductions but no reliefs on reducing prices on basic items.

For the investors “the angel tax” was abolished which shows a positive sign but increased the STT rates and CGT which saddens some prime experts. Whereas, we witnessed while FM Sitharaman giving the speech the share market seemed a bull in the NIFTY comp and bank and ended with a bear.

However, the government focuses on investment in energy sectors, housing infrastructure, Reforms in TDS, Direct tax, Customs duty, next-generation reforms, and boosting rural, agro sectors, research and development sectors, etc. Whereas, the corporate tax has been reduced for foreign companies.

Many experts after hearing about the budget 2024, react with a nominal but long-term progressive budget for achieving higher core infrastructural goals. Thus, it seems rational that the government focuses on empowering youth and women while bringing attractive incentives to MSMEs.